Introduction: Understanding Patience (Sabr) meaning in Islam

Patience Meaning in Urdu refers to Sabr (صبر), one of the most important qualities in Islam. It means staying strong, waiting calmly, and trusting Allah (SWT) when facing difficulties. Islam teaches that patience is not just about enduring hardship but about maintaining faith and seeking Allah’s guidance in all aspects of life.

In this article, we will explore Patience Meaning in Urdu, its significance in Islam, and what the Quran and Hadith say about it. We will also highlight Dua for patience, Sabr ki dua, and Quran verses about patience, which can help us develop this valuable quality.

1. Patience Meaning in Urdu and Its Origins

The Urdu word for patience is صبر (Sabr), which originates from Arabic. In Islamic teachings, Sabr means to remain patient, control emotions, and continue believing in Allah (SWT) during times of hardship.

Different types of patience include:

- Sabr in worship – Regularly fulfilling religious obligations like prayer and fasting.

- Sabr in hardship – Facing difficulties with strength and faith.

- Sabr in avoiding sin – Avoiding wrong actions and staying on the right path.

2. The Importance of Sabr in Islam

Patience is a great quality of a true believer. The Quran and Hadith highlight the importance of patience and its greater rewards. The Prophet Muhammad (PBUH) stated that patience is half of faith (Iman).

One important Quran verse about patience states:

“Indeed, Allah is with the patient.” (Surah Al-Baqarah 2:153)

This verse reassures us that Allah’s (SWT) guidance and blessings are granted to those who practice patience.

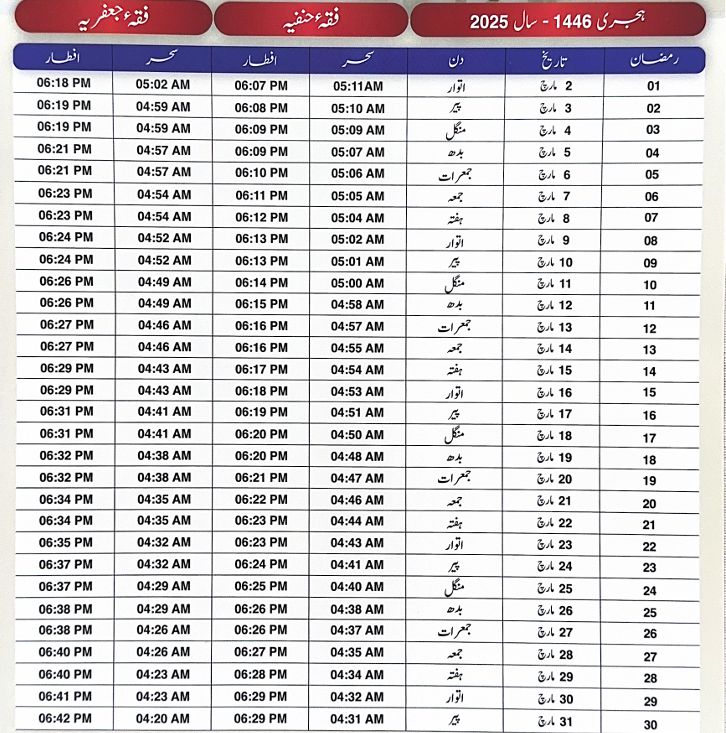

3. Sabr and Ramadan: The Month of Patience

Ramadan is known as the month of patience (شہر الصبر). Muslims fast from sunrise to sunset, controlling hunger, thirst, and emotions, which builds self-control and strengthens faith.

The Prophet Muhammad (PBUH) said:

“Fasting is half of patience.” (Ibn Majah 1745)

During Ramadan, we can recite Sabr ki dua, make prayer for patience, and reflect on Quran verses about patience to build inner strength beyond the holy month.

4. Quranic Verses About Patience (Sabr Ayat in Quran with Urdu Translation)

The Quran contains many Sabr ayat in Quran with Urdu translation, highlighting the rewards of patience. Some important verses include:

These verses highlight that patience brings great rewards from Allah (SWT).

5. Hadiths About Patience: The Teachings of Prophet Muhammad (PBUH)

The Prophet Muhammad (PBUH) showed patience in every aspect of his life. Some key hadiths on patience include:

- The Prophet (PBUH) said:“Whoever remains patient, Allah will grant him patience. No one is given a better gift than patience.” (Sahih Bukhari 1469)

- Another hadith states:“True patience is at the first moment of calamity.” (Sahih Bukhari 1302)

These hadiths show that patience is a special gift from Allah and a way to grow spiritually.

6. Dua for Patience: Powerful Prayers for Sabr

Islam teaches making dua for patience. Some powerful Dua for patience (Sabar ki dua or Dua for sabr) include:

- رَبَّنَا أَفْرِغْ عَلَيْنَا صَبْرًا وَثَبِّتْ أَقْدَامَنَا وَانصُرْنَا عَلَى الْقَوْمِ الْكَافِرِينَ“Our Lord, pour upon us patience, make our steps firm, and assist us against the disbelievers.” (Surah Al-Baqarah 2:250)

- اللَّهُمَّ إِنِّي أَسْأَلُكَ الصَّبْرَ“O Allah, I ask You for patience.”

Reciting these duas helps in developing strength during challenging times.

7. How to Develop Patience in Daily Life

To develop patience, one can:

- Practice self-control – Manage emotions and avoid quick reactions.

- Make dua regularly – Seek Allah’s guidance for patience.

- Trust in Allah’s plan – Believe that every challenge has wisdom behind it.

- Maintain positivity – Focus on blessings rather than difficulties.

8. Be Patience Meaning in Urdu: Lessons from Islamic History

The phrase “Be Patience Meaning in Urdu” translates to صبر کرو. Many prophets and great Islamic figures showed patience, such as:

- Prophet Ayub (AS) – Faced serious illness and loss but stayed strong in faith.

- Prophet Yusuf (AS) – Dealth with lies and betrayal with patience and trust in Allah (SWT).

- Prophet Muhammad (PBUH) – Faced difficulties and opposition with strength and patience.

These stories inspire us to remain patient in our personal struggles.

9. Staying Strong in Difficult Times with Sabr

Life is full of trials, but patience enables us to handle challenges carefully. Important steps to strengthen patience include:

- Reading sabar ayat – Seeking comfort in Quranic verses.

- Seeking support – Gaining support from family and friends.

- Practicing gratitude – Appreciating blessings even in hardships.

10. The Rewards of Patience (Sabr ka Inam in Islam)

Islam promises great rewards for those who practice patience:

Patience not only strengthens faith but also leads to everlasting success.

Conclusion: The Power of Sabr in Strengthening Faith

Sabr is an important quality in Islam, helping believers trust Allah, remain strong, and grow spiritually. By reciting Sabr ki dua, making prayers for patience, and reflecting on Quran verses about patience, we can face life’s challenges with confidence.

Let us remember Allah’s (SWT) words:

“Indeed, Allah is with those who are patient.” (Surah Al-Baqarah 2:153)